#Industry Debt collector

Explore tagged Tumblr posts

Text

I think one of my favorite video game locations is the despicable Alice In Wonderland themed fast food joint in SH shattered memories. it's so goddamn awful in there I love it, I also like that the roof is just close enough to the roof of the brothel next door that you can just jump it. I also like that this place and a brothel are right next to the high-school

#entries#sh#i love that past 4 all the sh games depict silent hill itself as a nasty fucking trash town thats falling apart and miserable#before that they talk about it being a nice resort town but like. dp has the tourist traps of devils pit and the caves and shit but#its got that eastern european misery to it. homecoming adds some industrial misery and origins has the dusty theratre and the sketchy motel#but sm bc it rebuilds the town to make it make some sense is just SO good with that awful vibe#i also love the decrepit mall thats literally forclosed on if you call the number where they redirect debt collectors#the shitty antique store. the horrible fucking amusment park#sm is so underrated tbh

10 notes

·

View notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

133 notes

·

View notes

Text

find some stuff to do magic about (feat. practicing sorcery is fun and good)

Do you want to do magic? Yes. Do you know what to do magic on? Maybe not. Here is a post for that. Take what you like and leave the rest behind.

Confront your learned helplessness face on because I'll bet money that there's a shit ton of stuff in your life you'd change if you hadn't trained yourself to pave it over just to make your highway of life a little less bumpy.

Let me tell you something I believe. I believe that most all of us have been trained to think that:

wanting things to go well,

wanting to be happy,

wanting little joys and pleasures in life,

and wanting not to be aggravated by the small things

somehow makes us weak, lacking, immature, or insecure,

or even worse,

that putting up with bullshit is somehow automatically makes us a better person, as if we've all got a cosmic thermometer that won't ding "good person!" until we've had it up to here with bullshit and then still force ourselves to grin and bear it.

"If I do magic to shorten the Starbucks drive-through doesn't that make me impatient? I don't want to use magic as spiritual bypassing in order to avoid my flaws."

Well then. Far be it from me to decry the kratophany of Prometheus getting his liver pecked out by eagles every day, manifest in your sacred sacrifice of having your minutes pecked out of your day, one by one, as you wait in line.

Make a list. Keep it with you. On paper, on your phone. Doesn't matter. It's a list of things you'd like to change. Little fleeting things that rear their head only for a second or so before our industrial-powered steamrollers smash it into the ground. Big things that you stew over day to day.

No problem is too petty. No splinter in your side is too insignificant. Betty at the office blows her nose every day at 8:15am and if you have to hear it one more time you are going to burn the building down? Put it on the list.

Do you have to leave 20 minutes early for work on Thursdays because a freight train blocks the freeway for five minutes and your city backs up like Betty's nose? What is magic going to do, rearrange the city's entire traffic patterns? Maybe so. Who cares. That's magic's problem, not yours. Put it on the list.

Have your eye on quite a cute designer bag? Does it cost your monthly rent? Put it on the list.

Learn to stare your life in the eye again with the verv of someone who has just found a reality-warping gun with unlimited ammunition. Game night gets cancelled too often? You never remember to use your pizza coupons? You can never remember to get ginger ale at the store? Put it on the list.

Feed yourself what ails you like a crab going absolutely bonkers in a plankton-filled tank.

just do some of that normal "witchy" stuff, why not

Protections: Not only for spirits and stuff!

Against unwanted solicitors

Against your room mate's creepy partner coming over

Against debt collectors finding your new phone number

Against surprise quizzes in your course

Against nightmares

And from time to time a sorcerer does like a good house ward. Experiment with yours, why not? Waiting until you're under attack to learn how to put up protections is like waiting until you're drowning to learn swimming. Sure, the sheer adrenaline-fueled terror might get you somewhere - or it might get in the way.

You don't normally use altars? Build one, why not. Build secret ones in shoe boxes. Experiment with altars and compound magic.

Perhaps you'd like a mini spellcasting kit to go? I don't know if making one counts as doing magic, but it's fun to make them.

Why not develop and prepare an oil or incense blend that must steep for a few months before it's ready? You don't need it now, right? So that means it's prime time to make things that are supposed to "mature" before use.

And hey, what's the deal with cleansing? A lot of people make fun of it now. Some people say it's important and necessary. Why not get really into cleansing and develop your own take? Practice gentle cleansing, nuclear cleansing, cleansing with pure energy and cleansing with candles, cleansing with cleaning products and cleansing with joy.

casting a spell right now is not the same thing as activating it right now and you can still gain a lot of experience in magic without releasing spells into the wild

I think that a lot of people think of spells as I light the candle and the spell is activated and it goes and does the thing, so if there is no Thing right now, then I can't cast the spell,

whereas if you reframed it as I am creating a spell-creachur that will hibernate in this little vessel until I spill it out into the world,

you may actually find that there are dozens of spells for you to actively develop, experiment with, cast, learn from, and passively benefit from - without necessarily needing any of them right now.

And the benefit is, if you don't actually need it right now, that takes a ton of pressure off of you. If you're not acting out of desperation, experimentation can be very fun indeed.

What about the most intense jaw-breakingly stupid strong protective amulet you've ever conceived of? Make it, why not. Make five prototypes on your journey to the strongest danged protection amulet this side of social media.

Who cares if you don't need them? Maybe some day you'll meet someone who does. Or, you know, magic is fun and doing it is its own reward.

What about a talisman for dreamwork and astral travel? Make something that reeks so intensely of the moon that it launches people out of their bodies just by walking past it.

Decide to perfect the most dazzling money-drawing candle spell. Make that your thing. You don't need cash right now? No worries; donate it to charity.

Have fun. Experiment. Made something that came through a little too hard and now it's causing problems? What a wonderful opportunity to learn how to disassemble a spell vessel.

Make yourself a cabinet full of enchantments. Learn how to contain the energy radiating off of all those enchantments. Realize you need more space and learn to combine multiple similar enchantments into one vessel.

make trusting friends who will let you cast on them.

(self explanatory)

710 notes

·

View notes

Text

Joe 2.0 : I won't be fooled again, I won't go into the modeling or stunt industry too many backstabbers and liars

Debt collectors :

45 notes

·

View notes

Text

I just added a few tags to a gifset and it made me want to write a post.

(SS of gifs by @/poomphuripan )

This is what Ming tells Joe over and over again. He has said something similar before too. In episode 5 when Ming kept Joe chained- he offered his resources to push Joe into fame, in exchange of which he demanded that Joe let go of the project he had with Sol.

Now at that time Joe wasn't doing anything in want of fame. He had just found out that the guy he thought to be his boyfriend, was merely using him as a replacement for an actor...the same actor for whom Joe was a stand in to professionally. Adding salt to the wound is the fact that Tong became famous by taking all the credits of the stunts Joe did. So to show Ming that he is as talented as Tong, if not more- Joe said yes to Pao's offer.

( a digression: even Tong is not mighty in the industry, Wut says that the CEO of the company would side with Pao in firing Tong because big men stick together. Tong had to humiliate Pao for Joe to be blacklisted).

Now in this new life after the soul transmigration and all- we have Joe wanting to stick to the shadows even more than before: content in working in the props department of all things, even when Wut offered him some work as a model. It is after Ing got roughed up by the debt collectors that he approached Wut to beg for a chance to be a stuntman again. And even then he refused Joy's offer- only rushing back to her to offer himself up to Tong once again, when it became clear that the only way to save Ing is if she goes to daily dialysis.

So what I am trying to say in rehashing all of this is that money is a huge factor now. It is what motivated him to make a deal with Ming for one year- the debts accrued by Ing and Ing's well being. Joe worked in Sol's music video because he needed the money for his new mom...none of it has ever been for fame.

And Ming knows Joe needs the money- fame brings in money. The first time he goes to Ing's house is after knowing that she has been hospitalized- he offers Joe fame/money etc in exchange of him being a stand in.

Ming is doing the same thing here too. Cornering Joe with "you are new to the industry, you don't want to appear hard to work with in front of the paparazzi" and offering his resources up once again for Joe- so that Joe may come back to him and accept him as his lover.

And I know all of this is sounding repeatitive but what I am trying to say is so much of Ming's power over Joe is materialistic. This is what he offers Joe again and again as something tempting...and it makes you wonder- had Ing not being indebted to loan sharks/ had Ing not being sick, how much of this would Joe put up with?

what would have happened if Joe was transmigrated into the body of a rich man- what if in this new life he had amples to his name. What would then Ming have to offer Joe to coerce him back?

In an industry where poor newbies are pimped off to rich men by CEO himself- how much of Ming would Joe have put up with and what else would have Ming had to do, what work would have Ming had to put in for Joe to even consider talking to someone he holds responsible for his death...

Another question I have is, had Joe not been a mere stuntman and instead were someone important in the industry- would Ming dare to be so callous to him previously? Ming could do what he did because he clocked in on Joe's loneliness and his desire for Ming...So my question is how much would have material wealth changed Joe's life? Would Sol be more receptive to Joe's advances? since then he wouldn't be suspicious of Joe's intentions about using his fame...would Joe and Sol be a thing then?

I find so much of this storyline is based on the difference of social status and exploitation of that...

24 notes

·

View notes

Text

In which a Debt Collector Roasts this Article

First off, this is a 2015-SEO-optimized article to whitewash collection companies. The article also never gets to the part of debtor rights.

A Roasting Attempt

Unpaid medical debt is reaching epidemic proportions as Corona pandemic.

What in the crappy copywriting is this. Where's the rest of that poor sentence? Was it mutilated? Sacrificed at Mamnon's altar?

Also, no shit. It's not like people's immune systems aren't being ravaged by a lymphocyte-disabling airborne disease.

Every healthcare service facility is looking for a trusted partner to outsource medical collection process.

Yes, and they're going to subcontract a significant portion of the operations to some poor devil in a poorer country (*waves hand*) to maximize profits.

If we go by surveys, health companies lose about 10-15% revenue every year due to debts incurred on them.

Don't you mean projected revenues, a.k.a imaginary investor expectations? Nothing was lost if it wasn't real in the first place.

A medical collection agency handles the work that an in-house team is not able to handle efficiently.

Most U.S. people do not know this, but a lot of medical bills aren't sold. Healthcare institutions subcontract medical debt collections agencies. These agencies get paid a flat rate plus a percentage of recovered fees.

Now you know another reason why U.S. healthcare is so expensive: Your doctor's bills have to pay for imaginary revenue, collection agency rates for other people's unpaid debt, and commissions. It's a pyramid scheme and you're at the bottom.

Outsourcing medical bill debt collection service is beneficial for the healthcare industry.

Fuck the patients, amirite?

We are one of the most trusted medical debt collection companies globally. We strive to build a focused and streamlined medical collection strategy. This will enhance the collection, cut costs, save time and enhance resources procuring. We work on No Win No Fee policy.

I dunno, man, that English is suuuuuuuuuuuus (bolded). I think you even outsourced website copywriting—and you didn't even hire the good ESLs.

Our latest software and well-equipped human resource solutions deliver error-free results.

Honestly, the companies I've worked for pay for shitty servers that disconnect during calls, even when our local internet is running at mega speeds.

We know how important is your business reputation and relationship with your patients.

Do medical debt collectors have a good reputation anywhere? Genuinely curious.

Our expert professional takes care of medical collection services and helps in improving revenue performance. With our healthcare debt collection services companies can enhance their cash flow.

You keep saying “expert professionals”, yet I don't think I ever got more than a month of training. Maybe the industry trains more U.S.-based staff because they can be personally sued?

Industry is finding difficulty in recover past-due bills from insurance companies and patients. Medical debt is the largest percentage of consumer debt in collections. As it is getting difficult for healthcare industry to recover debt by in-house so companies are hiring medical collection agency to help collect their past due accounts.

But think of the poor healthcare institution shareholders who aren't getting their money's worth!

Tax write-off, people.

This is because no medical insurance refunds 100% bill amounts.

Serious: A lot of patients are naïve about this fact. But I've insurance! Yes, and it's a scam, it's just that without it the scam gets worse.

The medical debt collection companies are professionals and will help in retaining customers or patients as they are good in negotiating.

AHAHAHAHAHAA I'VE BEEN CURSED OUT SO MANY TIMES

that is definitely an excellent relationship with “customers”

—————————————————————————————————

You never got to this bit:

In this article, we shall explain how medical debt collection agencies work and what you can do to deal with them. We shall also tell you what your rights are and how to protect yourself from unfair practices.

But this was never about debtor rights but about ranking in Google search results to generate profit off collections.

How Do Medical Debt Collection Companies Work?

Have you ever received a call from a healthcare debt collector? It can be really scary, especially if you do not know how the process works. Medical debt collection companies are different from regular debt collectors, and they can be a little harder to deal with. In this article, we shall explain how medical debt collection agencies work and what you can do to deal with them. We shall also tell you what your rights are and how to protect yourself from unfair practices. So, if you have been dealing with medical debt collectors, or you are just curious about how they work, keep reading.

8 notes

·

View notes

Text

WASHINGTON, D.C. - The Consumer Financial Protection Bureau (CFPB) today proposed a rule that would remove medical bills from most credit reports, increase privacy protections, help to increase credit scores and loan approvals, and prevent debt collectors from using the credit reporting system to coerce people to pay. The proposal would stop credit reporting companies from sharing medical debts with lenders and prohibit lenders from making lending decisions based on medical information. The proposed rule is part of the CFPB’s efforts to address the burden of medical debt and coercive credit reporting practices.

"The CFPB is seeking to end the senseless practice of weaponizing the credit reporting system to coerce patients into paying medical bills that they do not owe,” said CFPB Director Rohit Chopra. "Medical bills on credit reports too often are inaccurate and have little to no predictive value when it comes to repaying other loans."

In 2003, Congress restricted lenders from obtaining or using medical information, including information about debts, through the Fair and Accurate Credit Transactions Act. However, federal agencies subsequently issued a special regulatory exception to allow creditors to use medical debts in their credit decisions.

The CFPB is proposing to close the regulatory loophole that has kept vast amounts of medical debt information in the credit reporting system. The proposed rule would help ensure that medical information does not unjustly damage credit scores, and would help keep debt collectors from coercing payments for inaccurate or false medical bills.

The CFPB’s research reveals that a medical bill on a person’s credit report is not a good predicter of whether they will repay a loan. In fact, the CFPB’s analysis shows that medical debts penalize consumers by making underwriting decisions less accurate and leading to thousands of denied applications on mortgages that consumers would repay. Since these are loans people will repay, the CFPB expects lenders will also benefit from improved underwriting and increased volume of safe loan approvals. In terms of mortgages, the CFPB expects the proposed rule would lead to the approval of approximately 22,000 additional, safe mortgages every year.

In December 2014, the CFPB released a report showing that medical debts provide less predictive value to lenders than other debts on credit reports. Then in March 2022, the CFPB released a report estimating that medical bills made up $88 billion of reported debts on credit reports. In that report, the CFPB announced that it would assess whether credit reports should include data on unpaid medical bills.

Since the March 2022 report, the three nationwide credit reporting conglomerates – Equifax, Experian, and TransUnion – announced that they would take many of those bills off credit reports, and FICO and VantageScore, the two major credit scoring companies, have decreased the degree to which medical bills impact a consumer’s score.

Despite these voluntary industry changes, 15 million Americans still have $49 billion in outstanding medical bills in collections appearing in the credit reporting system. The complex nature of medical billing, insurance coverage and reimbursement, and collections means that medical debts that continue to be reported are often inaccurate or inflated. Additionally, the changes by FICO and VantageScore have not eliminated the credit score difference between people with and without medical debt on their credit reports. We expect that Americans with medical debt on their credit reports will see their credit scores rise by 20 points, on average, if today’s proposed rule is finalized.

Under the current system, debt collectors improperly use the credit reporting system to coerce people to pay debts they may not owe. Many debt collectors engage in a practice known as “debt parking,” where they purchase medical debt then place it on credit reports, often without the consumer’s knowledge. When consumers apply for credit, they may discover that a medical bill is hindering their ability to get a loan. Consumers may then feel forced to pay the medical bill in order to improve their credit score and be approved for a loan, regardless of the debt’s validity.

Specifically, the proposed rule, if finalized would:

Eliminate the special medical debt exception: The proposed rule would remove the exception that broadly permits lenders to obtain and use information about medical debt to make credit eligibility determinations. Lenders would continue to be able to consider medical information related to disability income and similar benefits, as well as medical information relevant to the purpose of the loan, so long as certain conditions are met.

Establish guardrails for credit reporting companies: The proposed rule would prohibit credit reporting companies from including medical debt on credit reports sent to creditors when creditors are prohibited from considering it.

Ban repossession of medical devices: The proposed rule would prohibit lenders from taking medical devices as collateral for a loan, and bans lenders from repossessing medical devices, like wheelchairs or prosthetic limbs, if people are unable to repay the loan.

The CFPB began today’s rulemaking in September 2023 with the goals of ending coercive debt collection practices and limiting the role of medical debt in the credit reporting system. The CFPB additionally published in 2022 a report describing the extensive and debilitating effects of medical debt along with a bulletin on the No Surprises Act to remind credit reporting companies and debt collectors of their legal responsibilities under that legislation.

Read today’s proposed rule, Prohibition on Creditors and Consumer Reporting Agencies Concerning Medical Information (Regulation V).

Read the Unofficial Redline of the Prohibition on Creditors and Consumer Reporting Agencies Concerning Medical Information (Regulation V).

Comments must be received on or before August 12, 2024.

Learn more about Credit Reporting Requirements and the CFPB’s work on medical debt.

Consumers can submit credit reporting complaints, or complaints about financial products or services, by visiting the CFPB’s website or by calling (855) 411-CFPB (2372).

Employees who believe their company has violated federal consumer financial protection laws are encouraged to send information about what they know to [email protected].

33 notes

·

View notes

Text

[“How do we, today, make the poor in America poor? In at least three ways. First, we exploit them. We constrain their choice and power in the labor market, the housing market, and the financial market, driving down wages while forcing the poor to overpay for housing and access to cash and credit. Those of us who are not poor benefit from these arrangements. Corporations benefit from worker exploitation, sure, but so do consumers who buy the cheap goods and services the working poor produce, and so do those of us directly or indirectly invested in the stock market. Landlords are not the only ones who benefit from housing exploitation; many homeowners do, too, their property values propped up by the collective effort to make housing scarce and expensive. The banking and payday lending industries profit from the financial exploitation of the poor, but so do those of us with free checking accounts at Bank of America or Wells Fargo, as those accounts are subsidized by billions of dollars in overdraft fees. If we burn coal, we get electricity, but we get sulfur dioxide and nitrogen oxide and other airborne toxins, too. We can’t have the electricity without producing the pollution. Opulence in America works the same way. Someone bears the cost.

Second, we prioritize the subsidization of affluence over the alleviation of poverty. The United States could effectively end poverty in America tomorrow without increasing the deficit if it cracked down on corporations and families who cheat on their taxes, reallocating the newfound revenue to those most in need of it. Instead, we let the rich slide and give the most to those who have plenty already, creating a welfare state that heavily favors the upper class. And then our elected officials have the audacity—the shamelessness, really—to fabricate stories about poor people’s dependency on government aid and shoot down proposals to reduce poverty because they would cost too much. Glancing at the price tag of some program that would cut child poverty in half or give all Americans access to a doctor, they suck their teeth and ask, “But how can we afford it?” How can we afford it? What a sinful question. What a selfish, dishonest question, one asked as if the answer wasn’t staring us straight in the face. We could afford it if we allowed the IRS to do its job. We could afford it if the well-off among us took less from the government. We could afford it if we designed our welfare state to expand opportunity and not guard fortunes.

Third, we create prosperous and exclusive communities. And in doing so, we not only create neighborhoods with concentrated riches but also neighborhoods with concentrated despair—the externality of stockpiled opportunity. Wealth traps breed poverty traps. The concentration of affluence breeds more affluence, and the concentration of poverty, more poverty. To be poor is miserable, but to be poor and surrounded by poverty on all sides is a much deeper cut.Likewise, to be rich and surrounded by riches on all sides is a level of privilege of another order.

We need not be debt collectors or private prison wardens to play a role in producing poverty in America. We need only to vote yes on policies that lead to private opulence and public squalor and, with that opulence, build a life behind a wall that we tend and maintain. We may plaster our wall with Gadsden flags or rainbow flags, All Lives Matter signs or Black Lives Matter signs. The wall remains the wall, indifferent to our decorations.”]

matthew desmond, from poverty: by america, 2023

97 notes

·

View notes

Text

For a long time, one of my coworkers would buy these instructional videotapes. Dozens of them. The subject? How to win at casino games. Grinning, glad-handing, well-dressed men and women would tell you about all the blind spots, short cuts, and vulnerabilities of the gambling industry. They'd hook you on a flashy commercial, and before long, you'll have bought the whole 5-tape set.

I've never been one for gambling. Well, I guess you could say that driving a rotting motor vehicle at giga-illegal rates of speed with several glaring flaws and safety issues is "gambling," but I certainly don't like you phrasing it like that when we were having such a nice conversation. In the few times I've gone to a casino in my life, I immediately lost my entire budget and then quit. It's nice to not have an addiction to something, you know?

With age and perspective, I've determined that I was simply lucky. The worst thing that could have happened to me is that I win on my first trip. I'd have convinced myself that I could win again, that I have some kind of inherent right to the riches of the casino bosses, and then I'd lose all my money chasing that original rush. My coworker, who we'll call Stan because that is the name he legally got it changed to in order to skip town – I don't deadname people, unlike the police and debt collectors – was not as lucky as me. He won, and won big.

Watching the videotapes after he fled was sort of instructive. Because there were so many, and because process servers knew where he lived, he would often bring the tapes to work and watch them on our break-room VCR. I'd come in at lunch and catch a few minutes of them while I was waiting for our wheezing Sanyo microwave to finish shooting gluons through a can of soup. The appeal to orderliness, to a "system," was undeniably exciting. To believe yourself in possession of a unique set of knowledge, despite all evidence to the contrary, must have been nice.

Too bad I'm nothing like that, an entirely rational human being. When I buy fifty- and sixty-year-old shit box cars, I know exactly what I'm doing. I have internalized the system that they operate under, and even when they surprise me by draining my entire wallet into their gaping maw, I'll just win it all back the next week by scoring an excellent low-ball deal that will end up needing no maintenance. Stick that in your car payment and smoke it, suckers. I'm on the way up.

130 notes

·

View notes

Text

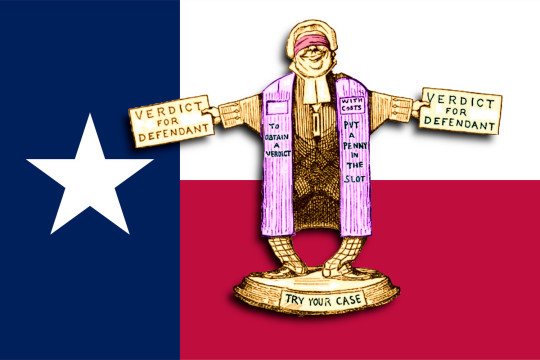

One of America’s most corporate-crime-friendly bankruptcy judges forced to recuse himself

Today (Oct 16) I'm in Minneapolis, keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing. Thursday (Oct 19), I'm in Charleston, WV to give the 41st annual McCreight Lecture in the Humanities. Friday (Oct 20), I'm at Charleston's Taylor Books from 12h-14h.

"I’ll believe corporations are people when Texas executes one." The now-famous quip from Robert Reich cuts to the bone of corporate personhood. Corporations are people with speech rights. They are heat-shields that absorb liability on behalf of their owners and managers.

But the membrane separating corporations from people is selectively permeable. A corporation is separate from its owners, who are not liable for its deeds – but it can also be "closely held," and so inseparable from those owners that their religious beliefs can excuse their companies from obeying laws they don't like:

https://clsbluesky.law.columbia.edu/2014/10/13/hobby-lobby-and-closely-held-corporations/

Corporations – not their owners – are liable for their misdeeds (that's the "limited liability" in "limited liablity corporation"). But owners of a murderous company can hold their victims' families hostage and secure bankruptcies for their companies that wipe out their owners' culpability – without any requirement for the owners to surrender their billions to the people they killed and maimed:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Corporations are, in other words, a kind of Schroedinger's Cat for impunity: when it helps the ruling class, corporations are inseparable from their owners; when that would hinder the rich and powerful, corporations are wholly distinct entities. They exist in a state of convenient superposition that collapses only when a plutocrat opens the box and decides what is inside it. Heads they win, tails we lose.

Key to corporate impunity is the rigged bankruptcy system. "Debts that can't be paid, won't be paid," so every successful civilization has some system for discharging debt, or it risks collapse:

https://pluralistic.net/2022/10/09/bankruptcy-protects-fake-people-brutalizes-real-ones/

When you or I declare bankruptcy, we have to give up virtually everything and endure years (or a lifetime) of punitive retaliation based on our stained credit records, and even then, our student debts continue to haunt us, as do lawless scumbag debt-collectors:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

When a giant corporation declares bankruptcy, by contrast, it emerges shorn of its union pension obligations and liabilities owed to workers and customers it abused or killed, and continues merrily on its way, re-offending at will. Big companies have mastered the Texas Two-Step, whereby a company creates a subsidiary that inherits all its liabilities, but not its assets. The liability-burdened company is declared bankrupt, and the company's sins are shriven at the bang of a judge's gavel:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Three US judges oversee the majority of large corporate bankruptcies, and they are so reliable in their deference to this scheme that an entire industry of high-priced lawyers exists solely to game the system to ensure that their clients end up before one of these judges. When the Sacklers were seeking to abscond with their billions in opioid blood-money and stiff their victims' families, they set their sights on Judge Robert Drain in the Southern District of New York:

https://pluralistic.net/2021/05/23/a-bankrupt-process/#sacklers

To get in front of Drain, the Sacklers opened an office in White Plains, NY, then waited 192 days to file bankruptcy papers there (it takes six months to establish jurisdiction). Their papers including invisible metadata that identified the case as destined for Judge Drain's court, in a bid to trick the court's Case Management/Electronic Case Files system to assign the case to him.

The case was even pre-captioned "RDD" ("Robert D Drain"), to nudge clerks into getting their case into a friendly forum.

If the Sacklers hadn't opted for Judge Drain, they might have set their sights on the Houston courthouse presided over by Judge David Jones, the second of of the three most corporate-friendly large bankruptcy judges. Judge Jones is a Texas judge – as in "Texas Two-Step" – and he has a long history of allowing corporate murderers and thieves to escape with their fortunes intact and their victims penniless:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

But David Jones's reign of error is now in limbo. It turns out that he was secretly romantically involved with Elizabeth Freeman, a leading Texas corporate bankruptcy lawyer who argues Texas Two-Step cases in front of her boyfriend, Judge David Jones.

Judge Jones doesn't deny that he and Freeman are romantically involved, but said that he didn't think this fact warranted disclosure – let alone recusal – because they aren't married and "he didn't benefit economically from her legal work." He said that he'd only have to disclose if the two owned communal property, but the deed for their house lists them as co-owners:

https://www.documentcloud.org/documents/24032507-general-warranty-deed

(Jones claims they don't live together – rather, he owns the house and pays the utility bills but lets Freeman live there.)

Even if they didn't own communal property, judges should not hear cases where one of the parties is represented by their long term romantic partner. I mean, that is a weird sentence to have to type, but I stand by it.

The case that led to the revelation and Jones's stepping away from his cases while the Fifth Circuit investigates is a ghastly – but typical – corporate murder trial. Corizon is a prison healthcare provider that killed prisoners with neglect, in the most cruel and awful ways imaginable. Their families sued, so Corizon budded off two new companies: YesCare got all the contracts and other assets, while Tehum Care Services got all the liabilities:

https://ca.finance.yahoo.com/news/prominent-bankruptcy-judge-david-jones-033801325.html

Then, Tehum paid Freeman to tell her boyfriend, Judge Jones, to let it declare bankruptcy, leaving $173m for YesCare and allocating $37m for the victims suing Tehum. Corizon owes more than $1.2b, "including tens of millions of dollars in unpaid invoices and hundreds of malpractice suits filed by prisoners and their families who have alleged negligent care":

https://www.kccllc.net/tehum/document/2390086230522000000000041

Under the deal, if Corizon murdered your family member, you would get $5,000 in compensation. Corizon gets to continue operating, using that $173m to prolong its yearslong murder spree.

The revelation that Jones and Freeman are lovers has derailed this deal. Jones is under investigation and has recused himself from his cases. The US Trustee – who represents creditors in bankruptcy cases – has intervened to block the deal, calling Tehum "a barren estate, one that was stripped of all of its valuable assets as a result of the combination and divisional mergers that occurred prior to the bankruptcy filing."

This is the third high-profile sleazy corporate bankruptcy that had victory snatched from the jaws of defeat this year: there was Johnson and Johnson's attempt to escape from liability from tricking women into powder their vulvas with asbestos (no, really), the Sacklers' attempt to abscond with billions after kicking off the opioid epidemic that's killed 800,000+ Americans and counting, and now this one.

This one might be the most consequential, though – it has the potential to eliminate one third of the major crime-enabling bankruptcy judges serving today.

One down.

Two to go.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

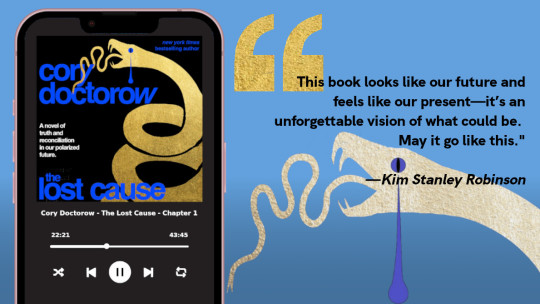

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#texas two-step#bankruptcy#houston#texas#mess with texas#corruption#judge david jones#fifth circuit#southern district of texas#elizabeth freeman#yescare#corizon#prisons#private prisons#prison profiteers#Michael Van Deelen#Office of the US Trustee#sacklers#bankruptcy shopping#johnson and johnson#impunity

259 notes

·

View notes

Text

"This is one for the history books of borked equilibriums. We devoted substantial efforts to pro-consumer legislation to address abuse of (mostly) poor people. We gated redress behind labor that is abundantly available in the professional managerial class and scarce outside of it, like writing letters and counting to 30 days. (People telling me they were incapable of doing these two things is why I started ghostwriting letters for debtors.) We now have literal computer programs exempting heuristically identified professional managerial class members from debt collection, inclusive of their legitimate debts, so that debt collectors can more profitably conserve their time to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

65 notes

·

View notes

Text

Tower Records (final visit); 2006.

Close to the end of the year, and also when the semester ended, I looked forward in selling my books after finals so that I would get money back. Then I got a friend together to go with me to Tower Records in Huntington. In a matter of one hour, that money would be gone. Right now I’d be very excited about what I would find in those bins. But for years it hasn’t been the case and the euphoria of being in a store, any store at midnight, has been long gone. The entire chain went under and currently co-opting it is a third-rate clothing store.

Autumn of 2006, people were standing on the sidewalks of Route 110 holding picket signs like it was the end of the world. First advertised on those signs were ten to thirty percent off all merchandise at Tower. When passers-by and sidewalk shoppers took a closer look, they ended up in shock as they realized that it was an end of an era of some sort. Time passed by and the stakes went up. Forty to sixty percent discounts finally garnered Tower’s final audience and rush of shoppers. The final swan song came when all merchandise was down to a whopping seventy to ninety percent off. That was when they had their biggest ever turnout because no one wanted to pay full price for music. Not then, not now.

Music collectors and fans were reluctant to buy any new release or any title that was full price. They all jumped at the opportunity to clean out Tower’s shelves with a steal. Buyers hovered and tracked entire sections looking for that one shining crown jewel that made their lifetime.

As a music fan for years, I couldn’t begin to tell you how much Tower shaped my taste in music and style. Unlike FYE and Sam Goody, Tower was the one commercial music chain that had a lot of artists and titles that no other commercial store had. Think of what was the Port Jefferson Music Den (closed down in 2002) where they were the one underground record store that had everything other stores didn’t even come close to carry. I remember Nineties summertimes visiting the Massapequa location picking up rare CD singles and imports as well as other rare hard-to-find and ahead-of-release-date CD’s and artists I picked up such as Autechre’s LP5 (1999) and EC8OR’s World Beaters (1998).

And being a fan of print media and graphic design, I also bought stacks of magazines every week. The magazine selection in Huntington was unrivaled, measuring at least several rows of sixty to seventy feet of anything and everything you could think of: industrial (Industrial Nation), punk (Punk Planet), experimental (Wire), graffiti (Disruptiv), style (Mass Appeal, Mean, Vice, YRB), and art design magazines (LoDown, especially LoDown because it satisfied my requirement for underground German pop-kultur) as well as hardcore zines (Short Fast Loud!, Maximum Rock And Roll, Under The Volcano) and other cult magazines I happened to be lucky to pick up (Lisa Carver’s Rollerderby, anyone?). Every month went at least sixty to seventy dollars total on magazines alone.

Yet towards the end of Tower’s presence I didn’t pick up on music as much because just like other buyers, I had to stand back at the higher-than-usual prices for releases. Compared to discount chains like Best Buy and other record stores, it wasn’t unusual to find a new release with no-frills to be priced at $19.99 or even $21.99. DVDs I noticed were priced at times to be five dollars higher than their competitors. Maybe some shoppers felt the same sentiment as I did.

Not only that, the forces of internet piracy and MP3 downloading of recent years proved to be too dominant and powerful to be stopped, and is currently co-existing with other existing record stores this day and age. Consumers then re-routed the system right to their own bedrooms with no price to pay for their music. These factors, plus incurring debt that led the chain to bankruptcy in 2004, proved to be too much for Tower.

Without Tower Records, it was less convenient for me to pick up whatever artist or movie title I wanted right away right after work. When Tower closed down it took a bite of some of the physical record collecting I had. Yet, only they could have given me these experiences: no more magazines letting me know what the latest art direction was or who was in the spotlight. No more frantically walking around with a huge stack of everything and more in my hands still looking for one more CD. No more back room full of posters, sheet music, jazz, classical, hip-hop, techno, and soul. No more silly Hollywood memorabilia and comic-book fantasy merchandise. No more video games, no more characters hanging out in the store wearing goth, back-pack indie, or hardcore.

No more attitudes from the employees who treated customers like nothing because they felt like it. That was really the only problem I had with Tower Records, mostly in Huntington. The cashiers pointed people out with a huff and puff because they were given more than enough change or money, or how they rang up a transaction without even making an emotion or saying a word. Some stuck female cashiers had that flat out know-it-all act for no apparent reason. Sometimes I even renounced the shop because of its sometimes poor service, but that was not the case in the end as the attitude did improve, thank you.

And no more of what would be where I had my first date with my Peruvian then-girlfriend Jenny. I would never forget wandering in that Huntington store looking for the next purchase when she walked in, greeting each other with open arms. We left when a thunderstorm knocked the power out, but we returned after dinner and had a fun time, the first of many for months to come. This was also where I met a pretty and pale Irish redhead who I later met again into at community college the following year.

What is now left of the record store scene on Long Island? A few of them which existed when Tower crumbled are still around and even new ones popped up. The majority of shops in total are still around because internet opinion made their case about the lack of quality, esthetics, art, and ritual of having the physical thing, making the case of cherishing these shops. On the online circuit, some titles are now being released in very limited quantity, mainly in the low thousands or even in the mere hundreds. It’s a huge drop-off from what the millions in print runs used to be. Naming your own price for digital downloads, sharing streams to the public, or even buying from the label or artist directly is the way to go nowadays.

Doing my Ω show, I do most of my music testing at home. My habits have been ruined by MP3s and streams as acquiring music is of very low cost and extremely ubiquitous. After all that, it hasn’t stopped me from going to a music warehouse in Shirley or celebrating Record Store Day annually in April to find breaks, samples, or dollar music to win it all. Yes, I still very much prefer to go out of town to buy music with my money which I support the artists and shops I like. Even to this day, I’ll be very happy spending two-hundred to two-fifty a visit, if I have it, on music just to have the artwork, colours, lyrics, pictures, ink, liner notes, credits, barcode, and the entire CD itself, because later on I will turn a profit in style points as time goes by, just like when people are hoarding and sharing their vinyl and cassette collections now.

November of 2006 was my last visit to Tower Records ever. Acquired would be some titles that made my pre-Ω shows and would be part of some personal mixtapes. Prices were forty percent off on music and that was when I decided to go and treat myself. There comes a time when you just can’t wait and risk a good sale on music before they no longer have stock. The total spent on my last ever visit to Tower Records was two-hundred on music and the Andy Warhol book at seventy-five, originally one-twenty-five. (Have you ever carried a book so massive and so heavy?) I took my bags worth of music and magazines with me to the trunk of my car, never to return to the Tower Records experience again.

On another note, I am in contact with M-Ro, a former manager of Tower Records, same location. He later on became a manager of a lifestyle store more out west and is now a ticket broker in an independent movie house. He once had a show on WUSB and was a major figurehead and darling of the Long Island underground and punk scene. You may also know his brother J-Ro, who still has a slot with us at WUSB.

Andy Warhol Giant-Size

Hatebreed Supremacy

Deftones B-Sides And Rarities

Boysetsfire The Misery Index: Note From The Plague Years

Lamb Of God Ashes Of The Wake

Throwdown Throwdown

Kill Your Idols From Companionship To Competition

Stereolab ABC Music

Pretty Girls Make Graves Elan Vitale

Roots Manuva Awfully Deep

A Tribe Called Quest The Low-End Theory

Leonard Cohen Death Of A Ladies’ Man

Jesu Silver

Jenny Lewis & The Watson Twins Rabbit Fur Coat

Stereolab Fab Four Suture

Boards Of Canada Trans-Canada Highway

Ladytron Light And Magic

Kid 606 Pretty Girls Make Raves

Buzzcocks, The Operator’s Manual

Public Image Ltd. Greatest Hits So Far

Roy Ayers Virgin Ubiquity 2

Flyleaf Flyleaf

various artists Punk v. Emo

Total cost: ~ $275.00

#omega#music#playlists#mixtapes#personal#Amdy Warhol#Hatebreed#Deftones#Boysetsfire#Lamb Of God#Throwdown#Kill Your Idols#Stereolab#Roots Manuva#A Tribe Called Quest#Leonard Cohen#Jesu#Jenny Lewis#Boards Of Canada#Ladytron#Buzzcocks#Public Image Ltd.#Roy Ayers

5 notes

·

View notes

Text

Drew Lakey quit her job as a physician assistant at the Skin and Cancer Institute in Delano, Calif., in November. She gave four months’ notice.

In late August, her former employer sued her, claiming she owed the company more than $138,000. The Skin and Cancer Institute was trying to make her repay $38,000 in training costs and more than $100,000 for “loss of business” caused by the company’s inability to transfer Ms. Lakey’s responsibilities to someone new.

Ms. Lakey had signed a training repayment agreement, or T.R.A., when she was hired. The contracts require workers to pay back training costs if they leave their jobs before the end of a certain period. The agreements are frequently presented late in the hiring process as a take-it-or-leave-it provision: No T.R.A., no job.

Ms. Lakey’s contract stated she would receive $50,000 worth of on-the-job training, a sum she’d be required to pay back on a prorated basis if she quit before 2025. The company didn’t explain the figure, which is more than the average cost of tuition for a year of physician assistant school. But in a complaint, the Skin and Cancer Institute said Ms. Lakey had agreed to the T.R.A. because it was providing her with a “high value” training.

The numbers didn’t make sense to her, but Ms. Lakey said she hadn’t seen the training repayment provision as a big risk at the time. “I thought there was nothing that could happen that would make me want to leave the contract early,” she said.

At the start of her job, Ms. Lakey, then 26, went through a three-month training period that involved shadowing another physician assistant while earning a reduced salary. Not long after she started, Ms. Lakey realized she wanted to leave but was afraid if she quit that she would be on the hook for tens of thousands of dollars. She quit anyway after deciding the company wasn’t a good fit. The Skin and Cancer Institute did not respond to multiple requests for comment.

Nearly 10 percent of workers who participated in a 2020 study by the Survey Research Institute at Cornell University reported being covered by a T.R.A. The arrangements are especially common in the nursing field and the trucking industry; one survey by National Nurses United found that nearly 40 percent of nurses who had joined the profession in the last decade had been subject to the practice.

Ashley Tremain, an employment lawyer in Texas, said she noticed the practice take off about five or six years ago, and she now hears from workers about T.R.A.s a few times a month.

“They’re just becoming ubiquitous,” she said, “as people are trying to find creative ways to move around noncompete restrictions,” which are gaining traction at the state and federal levels.

Ms. Tremain tends to hear from people after they’ve quit their jobs and received a letter from their former employer stating that they owe money for training. The most common dollar value she sees listed is $20,000. Enforcement can seem random at times, and Ms. Tremain said some employers seemed to send a relatively small proportion of cases to court or to debt collectors.

“It’s really an enormous amount of power that the employer holds in that situation,” she said.

Employers see T.R.A.s as a way to improve retention and prevent paying for training employees who then leave soon after.

Dan Pyne, a lawyer with Hopkins & Carley, a law firm in Silicon Valley, who has written T.R.A.s and represented employers enforcing T.R.A. contracts, said companies who came to him tended to fall into two categories: One group is made up of employers looking to shift some of the costs of their operations to employees, which is not legal in California. The other group is employers looking to help employees gain new skills that will serve them later on in their careers. This second type of T.R.A. is more legally enforceable.

“When the training is required by the employer, that is the employer’s cost of doing business, and they can’t force the employee to bear that cost or to reimburse that cost,” Mr. Pyne said. “But when the employee is going through the training voluntarily, primarily for their own benefit, in those situations, as a rule, the repayment obligation would be enforceable, and would be legal.”

The owner of Oh Sweet Skincare in Bellevue, Wash., sued a former employee for $2,244 — a sum that included $1,900 in training reimbursement and expenses related to a work conference. The employer, who asked not to be named for fear of harassment, said that she enforced the T.R.A. because employees who bounced from job to job were detrimental to small businesses like hers, and that she lost money on spending time to train new employees. She does not ask experienced employees to sign the agreements, she said, if they can prove they know the skills required to perform the services.